While TurboTax will be responsible for the correct preparation and filing of your return, you’re still on the hook for everything that goes into the calculation.įor context, the chances you’ll actually be audited are pretty slim. But – keep in mind that audit defense doesn’t protect you from improper inputs on your return, like claiming fraudulent deductible expenses or omitting 1099 income.

TURBOTAX REVIEW YOUR NUMBERS PROFESSIONAL

This is a pretty nice feature for $40, and ensures some professional guidance if you do get audited. A licensed tax professional would represent you by: One of Turbotax’s unique features is a premium service called “Audit Defense.” Basically, for an extra $40 Turbotax will handle all correspondence with the IRS if you get audited. And even better, in the years I received a refund, the funds were deposited in my account no more than a few days later. Earlier in my career, there were years when I filed a return through TurboTax in less than 20 minutes.

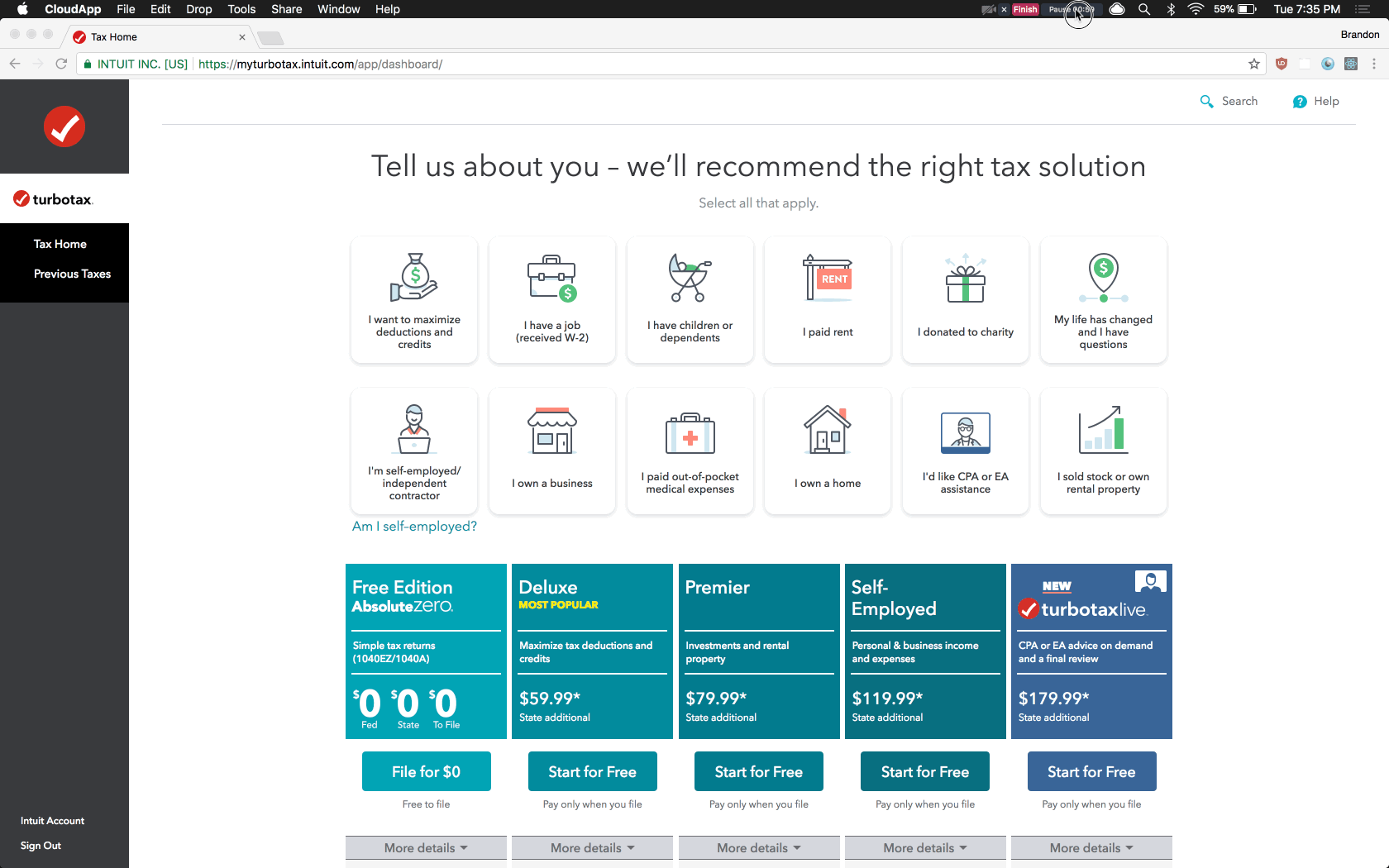

TURBOTAX REVIEW YOUR NUMBERS SOFTWARE

Most software has the functionality to import and compile your tax documents (like W-2s and 1099s) too, so you don’t even need to key in the data. There is potential for human error if you file taxes the old fashioned way, and for a small cost tax prep software eliminates most of that risk. Go figure, this is something computers are really good at. You compile data, fill in the boxes, sign your return, and mail it off. The preparation and filing of your return is a very operational job. The end result is your income for the year, which of course is what the amount of tax you owe is based on. You’re reporting on transactions that have already occurred – namely the income you received over the prior year less any deductions. Here’s Why I Like Tax Prep Softwareįiling your taxes is really a tax compliance function. And since he has income from the rental properties (which he’s depreciating to offset income) along with other large deductions like the interest on his mortgage and his home office, it’s likely that the value a CPA would bring would exceed their out of pocket cost. He has flexibility in how he runs his business, meaning there are many decisions to be made and potential planning opportunities. Jason would probably want to consult with a CPA. He bought a house with his wife, and they also own several rental properties. He quit his job to start his own architecture firm, which has done quite well. Jason’s situation has changed quite a bit. Yes he could claim some deductions here and there, but that’s nothing that tax prep software can’t handle. But outside of those options there’s not much planning to be done, since there are simply not many ways he could report his income. He could reduce his tax burden by contributing more to his employer’s 401k, an IRA, or potentially a health savings account (if he was enrolled in a high deductible health plan). Jason’s financial profile is pretty straight forward. He makes $60,000 per year in W-2 income, rents an apartment with a roommate, and contributes to his 401k. Jason is a 25 year old college graduate who’s just started his first job at a big architecture firm. The more complicated your financial profile becomes, the more decisions you’ll have to make, and the more important tax planning will become. While tax prep software is great and all, it’s really only useful for tax compliance. Tax compliance, on the other hand, has to do with preparing your return, filling out forms, and reporting on transactions that have already occurred. Tax planning is essentially planning transactions before they happen, and making thoughtful decisions that will minimize the total amount of tax you owe. When people talk about tax in general, there are really two sides to the conversation: tax planning and tax compliance. What You Should Know About Tax Prep Software Here’s my take on when you should ditch the software for an experienced professional. When your financial picture becomes sufficiently complicated, spending the extra cash to hire a professional can actually save you money in the long run. Any way to automate the prep and filing process in a compliant and inexpensive way is A-OK in my book.īut even though they’re easy to use, Turbotax and others are still software programs that have limitations just like any other robot.

Let me start by saying that I’m a big fan of most tax preparation software.

0 kommentar(er)

0 kommentar(er)